Summarize:www.chinabuses.org:

Part 2 Analysis of sales streams and market concentration of 10-11meter public transport buses Jan.-Nov. 2009

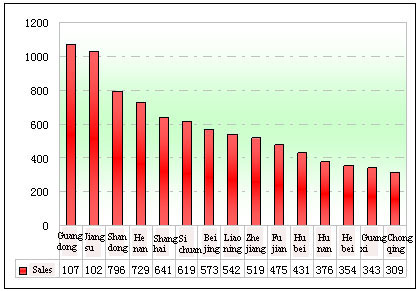

According to research center of Chinabuses.com, the top fifteen regional markets where sales volumes of 10-11meter buses from January to November 2009 are as followings:

Table 3 Statistics of sales volumes of 10-11meter buses in top fifteen regional markets Jan.-Nov. 2009 (Units: vehicle )

|

Rank

|

Regions

|

Sales

|

Concentration %

|

Note

|

|

1

|

Guangdong

|

1072

|

9.7

|

Contain NG

|

|

2

|

Jiangsu

|

1028

|

9.3

|

Contain NG

|

|

3

|

Shandong

|

796

|

7.2

|

Contain NG

|

|

4

|

Henan

|

729

|

6.6

|

Contain NG

|

|

5

|

Shanghai

|

641

|

5.8

|

Contain NG

|

|

6

|

Sichuan

|

619

|

5.6

|

Contain NG

|

|

7

|

Beijing

|

573

|

5.2

|

Contain NG

|

|

8

|

Liaoning

|

542

|

4.9

|

Contain NG

|

|

9

|

Zhejiang

|

519

|

4.7

|

Contain NG

|

|

10

|

Fujian

|

475

|

4.3

|

Contain NG

|

|

11

|

Hubei

|

431

|

3.9

|

Contain NG

|

|

12

|

Hunan

|

376

|

3.4

|

Contain NG

|

|

13

|

Hebei

|

354

|

3.2

|

Contain NG

|

|

14

|

Guangxi

|

343

|

3.1

|

Contain NG

|

|

15

|

Chongqing

|

309

|

2.8

|

Contain NG

|

|

|

合计

|

8807

|

79.7

|

Contain NG

|

Figure 3 Statistics of sales volumes of 10-11meter buses in top fifteen regional markets Jan.-Nov. 2009

It can be seen from above that the biggest sales volumes area of 10-11meter city buses is in Guangdong, sales volumes is 1,072 units, and market concentration is 9.7%; then comes Jiangsu, 1,028, 9.3%, Shandong, 796, 7.2%. And sales volumes in Shanghai is the largest among cities, sales volumes is 641 units, and market concentration is 5.8%; then comes Beijing, 573, 5.2%; then Chongqing, 309, 2.8%. Market concentration of the top fifteen regional markets is 79.7% illustrating that sales of ten-eleven-meter buses was not well-distributed, but to above regions and cities, and this can be taken as guidance for bus builders on marketing strategies and resource allocation.

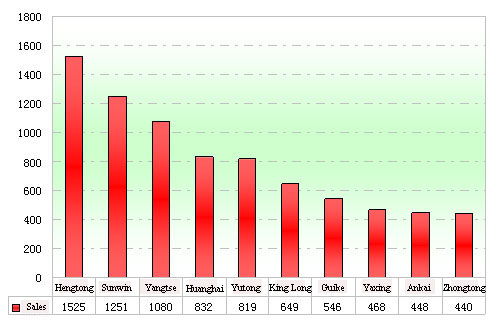

Part 3 Analysis of sales statistics of 10-11meter public transport buses Jan.-Nov. 2009

Table 4 Sales statistics of 10-11meter public transport buses by major bus builders Jan.-Nov. 2009

|

Rank

|

Bus Builders

|

Sales:Unit

|

Concentration %

|

Note

|

|

1

|

Hengtong

|

1525

|

13.8

|

Include 11 m, exclude 10 m

|

|

2

|

Sunwin

|

1251

|

11.3

|

Include 11 m, exclude 10 m

|

|

3

|

Dongfeng Yangtse

|

1080

|

9.8

|

Include 11 m, exclude 10 m

|

|

4

|

Huanghai

|

832

|

7.5

|

Include 11 m, exclude 10 m

|

|

5

|

Yutong

|

819

|

7.4

|

Include 11 m, exclude 10 m

|

|

6

|

King Long

|

649

|

5.9

|

Include 11 m, exclude 10 m

|

|

7

|

Guilin Bus

|

546

|

4.9

|

Include 11 m, exclude 10 m

|

|

8

|

Yaxing

|

468

|

4.2

|

Include 11 m, exclude 10 m

|

|

9

|

Ankai

|

448

|

4.1

|

Include 11 m, exclude 10 m

|

|

10

|

Zhongtong

|

440

|

4

|

Include 11 m, exclude 10 m

|

|

|

Total

|

8058

|

73

|

Include 11 m, exclude 10 m

|

Figure 4 Sales statistics of ten-eleven-meter public transport buses by major bus builders Jan.-Nov. 2009

It can be seen that:

a. Chongqing Hengtong Bus sold the most such public transport buses, 1,525 vehicles were sold out, and market concentration is 13.8%, then comes Shanghai Sunwin, 1,251, 11.3%, Dongfeng Yangtse, 1,080, 9.8%; market concentration of the first three manufacturers are 34.9%, which is over one third of market share, so we can see that degree of monopoly of ten-eleven-meter buses is comparatively high.

b. Market concentration of the first ten manufacturers is 34.9%, so other bus builders only have 27% chances to enter the market.