Summarize:www.chinabuses.org: Feature One: The roaring growth of intercity coaches are the main driving force for the general growth of China bus markets.

Fifty main China bus builders took over 95% markets share in the first three quarters this year, 148,401 buses were sold out, 105,273 of which were intercity coaches, and the share were 70.93%. Among the intercity coaches, 2.3% of which were sleeper buses.

|

|

Q1-Q3 2009

|

Q1-Q3 2010

|

Sales Growth

|

Per cent Growth

|

|

Bus

|

109266

|

148401

|

39135

|

35.82

|

|

Intercity coach

|

71898

|

105273

|

33375

|

46.42

|

|

Non-sleeper bus

|

69991

|

102857

|

32866

|

46.95

|

|

Sleeper bus

|

1907

|

2416

|

509

|

26.7

|

It can be seen from above that:

33,375 more intercity coaches were sold in the first three quarters this year, up 46.42%, and 509 more sleeper buses were purchased, up 26.7%, so we can see that the sales growth of China bus sales in the first three quarters were mainly driven by sales of intercity coaches.

39,315 more buses were purchased in the first three quarters in 2010 over 2009, up 35.82%, among which, sales of city buses were increased by 14.55%, and sales of coaches increased by 46.42%.

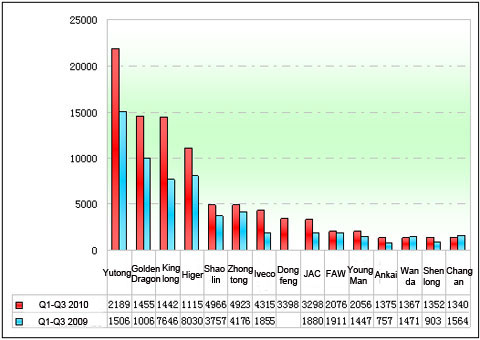

Feature two: Sales of Yutong, Kinglong, Higer, Golden Dradon were the main driver for the overall sales growth, and market concentration is heading to the main China bus builders.

|

Ranks

|

Bus builders

|

Q1-Q3 2010

|

Q1-Q3 2009

|

Growth

|

|

1

|

Yutong

|

21892

|

15060

|

45.37

|

|

2

|

Golden Dragon

|

14553

|

10069

|

44.15

|

|

3

|

Kinglong

|

14429

|

7646

|

88.7

|

|

4

|

Higer

|

11156

|

8030

|

38.9

|

|

5

|

Shaolin

|

4966

|

3757

|

32.2

|

|

6

|

Zhongtong

|

4923

|

4176

|

17.9

|

|

7

|

Iveco

|

4315

|

1855

|

132.6

|

|

8

|

Dongfeng

|

3398

|

|

|

|

9

|

JAC

|

3298

|

1880

|

75.4

|

|

10

|

FAW

|

2076

|

1911

|

86.3

|

|

11

|

Young Man

|

2056

|

1447

|

42.1

|

|

12

|

Ankai

|

1375

|

757

|

81.6

|

|

13

|

Wanda

|

1367

|

1471

|

-7.07

|

|

14

|

Sunlong

|

1352

|

903

|

49.7

|

|

15

|

Changan

|

1340

|

1564

|

-14.3

|

|

|

Total

|

92496

|

60526

|

47.2

|

Figure 1 Sales statistics of intercity bus sales in the first three quarters 2010

It can be seen from above that:

1. 92,496 intercity coaches were sold out in the first three quarters by the top fifteen bus builders, taking 85.06% sales of the top fifty bus builders, while their sales in last year took just 84.18% of the top fifty bus builders. So the sales growth in China bus industry can be seen from the sales growth of the fifteen bus builders. Their sales has grown from 60,526 units last year to 89,548 units this year, up to 47.2%.

2. Most of the top fifteen bus builders saw sales growth, 6,832 more Yutong buses, 4,484 more Kinglong buses, 3,126 more Higer buses were purchased.

3. Markets of top fourteen bus builders were 85.06% in the first three quarters, while the market concentration were 84.18% last year. And 30,000 more intercity buses were sold out in the first three quarters, up 47.2%, we can see that China intercity markets are much better than last year with higher market concentration.

a. Resources on intercity markets are heading to China main bus builders.

b. Although sales of city buses increased by 15% this year, the market share for intercity buses were still over 70%, and usually the profit margin for intercity coaches are bigger than city buses. In this case, main bus builders are heading to produce intercity coaches.

c. The situation cannot be changed in one or two years with fiercer competition in this market.

4. Sales of buses are increasing in China, and market concentration has always been high at the same time, and we can see that although main bus builders have already been accepted, there are still many small and medium bus builders. With fiercer competition in China bus markets, smaller bus builder have less and less chances.

5. According to above analysis, Yutong, Kingkong, Higer, Golden Dragon and Young Man have better state of operation, for profits from intercity buses are the biggest and vital for bus builders.