Summarize:

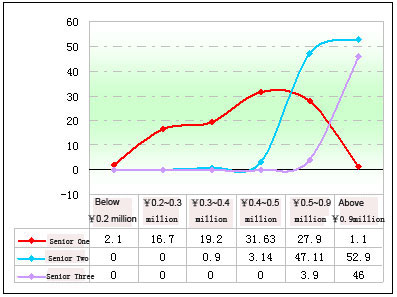

Part Four: Sales Analysis of Senior Medium & Large Coaches in Various Prices in Jan.- Feb. 2012

www.chinabuses.org

Table Four: Statistics of Senior Medium & Large Coaches Sales in Various Prices in Jan.- Feb. 2012

|

|

Senior One

|

Senior Two

|

Senior Three

|

|

Below¥0.2 million

|

2.1

|

0

|

0

|

|

¥0.2~0.3 million

|

16.7

|

0

|

0

|

|

¥0.3~0.4million

|

19.2

|

0.9

|

0

|

|

¥0.4~0.5 million

|

31.63

|

3.14

|

0

|

|

¥0.5~0.9 million

|

27.9

|

47.11

|

3.9

|

|

Above¥0.9 million

|

1.1

|

52.9

|

46

|

Chart Four: Statistics of Senior Medium & Large Coaches Sales in Various Prices in Jan.- Feb. 2012

From above data, it is seen that

1.In the segment market of the luxurious coaches worthy of below RMB 0.2 million , the Senior One luxurious coaches accounted for 2.1% of market share, and the corresponding product in this price area is around 7 meter Senior One medium luxurious coaches with air condition. Its corresponding market is the coaches used by the institutions & authorities business reception. There are no sales of Senior Two or Three coaches in this price area.

2.In the segment market of the luxurious coaches worthy of RMB 0.2~0.3 million , the Senior One luxurious coaches accounted for 16.7% of market share, and the corresponding product in this price area is around 7m~8m Senior One medium luxurious coaches. Its corresponding market is the medium & short distance tourist coaches and the coaches used by the institutions & authorities business reception. There are also no sales of Senior Two or Three coaches in this price area.

3.In the segment market of the luxurious coaches worthy of RMB 0.3~0.4 million , the Senior One luxurious coaches accounted for 19.2% of market share, and the corresponding product in this price area is around 8m~9m Senior One medium luxurious coaches. Its corresponding market is the medium & short distance city wide public transportation coaches and medium tourist coaches. The Senior Two luxurious coaches accounted for 0.90% of market share, and the corresponding product in this price area is around 9 meter long Senior Two medium luxurious coaches. Its corresponding market is in the medium distance intercity public transportation and luxurious medium tourist coaches.

4.In the segment market of the luxurious coaches worthy of RMB 0.4~0.5 million , the Senior One luxurious coaches accounted for 31.63% of market share, which is the biggest and the corresponding product in this price area is around 9m~11m sized Senior One medium & large luxurious highway public transportation coaches. The Senior Two luxurious coaches accounted for 3.14% of market share, and the corresponding product in this price area is around 9m~10m sized Senior Two medium luxurious highway transportation coaches and luxurious coaches used by senior tourism scenic spot.

5.In the segment market of the luxurious coaches worthy of RMB 0.5~0.9 million , the Senior One luxurious coaches accounted for 27.9% of market share, which is the second biggest and the corresponding product in this price area is above10m sized Senior One large luxurious highway public transportation coaches. The Senior Two luxurious coaches accounted for 47.11% of market share, and the corresponding product in this price area is around 10m~12m sized Senior Two medium luxurious intercity coaches and the luxurious coaches used by senior tourism scenic spot.

6.In the segment market of the luxurious coaches worthy of above RMB 0.9 million, the Senior Two and Three luxurious coaches accounted for more proportion of market share,which are the large luxurious coaches to represent the companies' brand image, the highway transportation used luxurious coaches and the luxurious coaches used by senior tourism scenic spot.

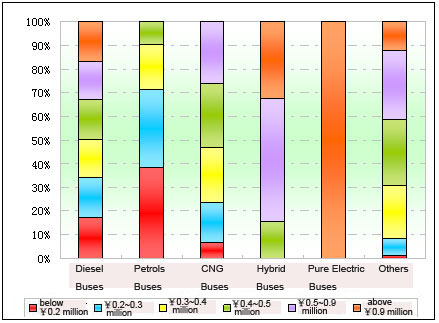

Part Five: The Features of Medium & Large Coaches Sales in Various Fuels in Jan.- Feb. 2012

The diesel buses accounted for the biggest proportion of the market share in the medium & large coaches. With the increasing of the oil prices, the sales of the oil buses decreased. In the hybrid bus market, it is mainly in the price of RMB 0.5~0.9 million coach market. And the pure electric bus market share is only in the price of above RMB 0.9 million coach market.

Table Five: Sales Proportion Statistics of Large & Medium Coaches in Various Fuels in Jan.- Feb. 2012

|

|

Diesel Buses

|

Petrols Buses

|

CNG Buses

|

Hybrid Buses

|

Pure Electric Buses

|

Others

|

|

Below¥0.2 million

|

90.3

|

8.2

|

1.2

|

0

|

0

|

0.3

|

|

¥0.2~0.3 million

|

88.3

|

7.2

|

3.1

|

0

|

0

|

1.4

|

|

¥0.3~0.4 million

|

87.1

|

4

|

4.3

|

0

|

0

|

4.6

|

|

¥0.4~0.5 million

|

86.1

|

2.1

|

4.9

|

1.1

|

0

|

5.8

|

|

¥0.5~0.9 million

|

85.6

|

0

|

4.8

|

3.7

|

0

|

5.9

|

|

Above¥0.9 million

|

87.4

|

0

|

0

|

2.3

|

7.8

|

2.5

|

Chart Five: Sales Proportion Statistics of Large & Medium Coaches in Various Fuels in Jan.- Feb. 2012

From the above data, it is seen that

1. The large and medium coaches which run on diesel fuel, dominate the coach market demand.

2. The large and medium coaches, which run on petrol fuel, the sales decreased with the increasing price of the oil. And in the price of above RMB 0.5 million coach market, there is no sales volume in it.

3. The large and medium coaches, which run on the compressed natural gas,the sales increased with the increasing price of the natural gas. But in the price of above RMB 0.9 million coach market, there is no sales in it.

4. The hybrid buses as one of the main new energy buses, there is no sales volume in the below RMB 0.4 million coach market. And in the price of above RMB 0.4 million coach market, the sales increased with the increasing price. But in the price of above RMB 0.9 million coach market, the sales of it decreased.

5. Only in the price of RMB 0.9 million coach market, the pure energy buses were sold in this price area.