Summarize:www.chinabuses.org:

Part One: General Analysis on the Market of Large & Medium Sized Coach Products in the First Quarter of 2012

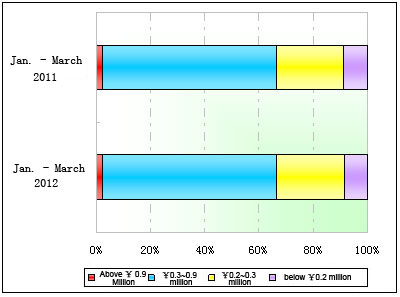

According to the various prices to segment the bus & coach market, the large and medium-sized coach market can be roughly divided into the luxurious coach products, mid range & luxurious coach products, low-grade & mid range coach products and low-grade coach products.

According the coach expert's opinion:

(1) the prices of the coaches above RMB ¥ 0.9 million (including RMB ¥ 0.9 million) are luxurious coach products, which contain the coach products in the fields of the above 300 km high way passenger transportation (including luxurious sleeper coaches), the senior spots' luxurious tourism transportation, the inter-city large public transport in the big cities etc. As these segments markets' demands on the luxurious coach products are generally small and limited, so the proportion of luxurious coach products in Jan.-March 2012 is only 2.08 percent.

(2) The prices of the coaches among RMB 0.3 ~ 0.9 million are mid range & luxurious coach products, which contain the coach products in the fields of the below 300 km high way passenger transportation, the mid & senior spots tourism transportation, the inter-city large public transport in the No.1 & No.2 lines cities etc. These segments markets' demands on the mid range & luxurious coach products are big, which makes it become the main force to push the development of the large and medium-sized coach market. And the proportion of mid range & luxurious coach products in Jan.-March 2012 is 64.6 percent.

(3) The prices of the coaches among RMB 0.2 ~ 0.3 million are mid range & luxurious coach products ( including mid range sleeper coaches), which contain the coach products in the fields of the among 50~100 km high way passenger transportation, the mid spots tourism transportation, the inter-city public transport in the small-medium cities etc. The proportion of mid range & luxurious coach products in Jan.-March 2012 is 24.8 percent.

(4) The prices of the coaches below RMB 0.2 million are low-grade coach products, which contain the coach products in the fields of rural area passenger transportation and suburban passenger transportation. The proportion of low-grade coach products in Jan.-March 2012 is 8.57 percent.

Table One: Statistics of large & medium sized coaches based in price ranges in Jan. - March 2012

|

|

Above ¥0.9 Million

|

¥0.3~0.9 million

|

¥0.2~0.3 million

|

Below ¥0.2 million

|

|

Jan. - March 2012

|

2.08

|

64.6

|

24.8

|

8.52

|

|

Jan. - March 2011

|

2.1

|

64.3

|

24.9

|

8.7

|

|

Year-on-year growth

|

-0.02

|

0.3

|

-0.1

|

-0.18

|

Chart One: Statistics of large & medium sized coaches based in price ranges in Jan. - March 2012

From above data, it is seen that

For the coach products valuing among ¥0.3~0.9 million, it has the biggest market share and the sales growth in the first quarter of 2012 , which is the mainstay in the market of large & medium sized coach market. The bus builders marketing enterprises could take the above data information as a guide in the fixed position of the prices and the marketing.

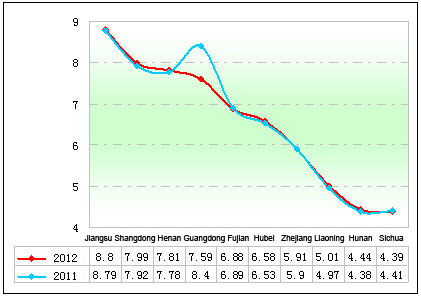

Part Two: Regional Market Share Analysis of RMB 0.3~0.9 million coach products in the first quarter of 2012

Based on the statistics from www.chinabuses.com research center, the market share of the mid range & luxurious coach products valuing among RMB 0.3~0.9 million in the top ten main regional markets show below:

Table Two: Statistics of RMB 0.3~0.9 million coach products in main regional markets in Jan. - March 2012

|

Regional Markets

|

2012

|

2011

|

Year-on-year growth

|

|

Jiangsu

|

8.8

|

8.79

|

0.01

|

|

Shangdong

|

7.99

|

7.92

|

0.07

|

|

Henan

|

7.81

|

7.78

|

0.03

|

|

Guangdong

|

7.59

|

8.4

|

-0.81

|

|

Fujian

|

6.88

|

6.89

|

-0.01

|

|

Hubei

|

6.58

|

6.53

|

0.05

|

|

Zhejiang

|

5.91

|

5.9

|

0.01

|

|

Liaoning

|

5.01

|

4.97

|

0.04

|

|

Hunan

|

4.44

|

4.38

|

0.06

|

|

Sichua

|

4.39

|

4.41

|

-0.02

|

|

Total

|

65.4

|

65.97

|

-0.57

|

Chart Two: Statistics of RMB 0.3~0.9 million coach products in main regional markets in Jan. - March 2012

1. Among the top ten regional area markets in China,in the RMB 0.3~0.9 million coach product market, the market share of the Jiangsu Province is the biggest which is 8.80 percent, which rose 0.01 percent from the same period of last year. Then it is followed by Shandong Province, which is 7.99 percent and it rose 0.07 percent from the same period of last year. The third one is Henan Province, which is 7.81 percent and it rose 0.03 percent form the same period of last year. The fourth one is Guangdong Province, which is 7.59 percent but it declined 0.81 percent from the same period of last year. The main regional markets are in the relatively dense population and well-developed provinces.

2. The total market share of the RMB 0.3~0.9 million coach products in top ten regional markets are 65.4 percent, which declined 0.57 percent from the same period of last year. It shows the market trends of it in the top ten regional markets are weakening.So the other regional markets are developing.