Summarize:www.chinabuses.org:

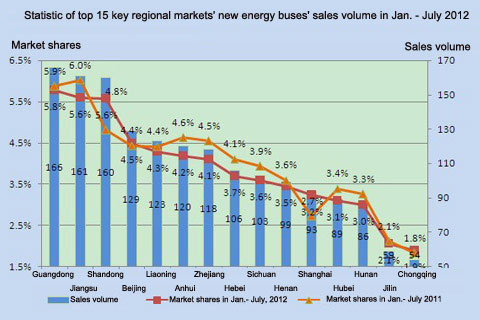

Part Three: General Sales Analysis on the Regional Markets of New Energy Bus in Jan. - July of 2012

Table Three: Statistic of top 15 key regional markets' new energy buses' sales volume in Jan. - July 2012

|

No.

|

Regional Markets

|

Sales volume

|

Market shares

|

Year-on-year growth

|

Remarks

|

|

1

|

Guangdong |

166

|

5.78

|

5.87

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

2

|

Jiangsu

|

161

|

5.6

|

6.02

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

3

|

Shandong

|

160

|

5.57

|

4.81

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

4

|

Beijing

|

129

|

4.49

|

4.43

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

5

|

Liaoning

|

123

|

4.28

|

4.41

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

6

|

Anhui

|

120

|

4.18

|

4.62

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

7

|

Zhejiang

|

118

|

4.1

|

4.54

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

8

|

Hebei

|

106

|

3.69

|

4.10

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

9

|

Sichuan

|

103

|

3.59

|

3.93

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

10

|

Henan

|

99

|

3.45

|

3.59

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

11

|

Shanghai

|

93

|

3.23

|

2.72

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

12

|

Hubei

|

89

|

3.10

|

3.39

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

13

|

Hunan

|

86

|

2.99

|

3.25

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

14

|

Jilin

|

59

|

2.05

|

2.11

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

15

|

Chongqing

|

54

|

1.88

|

1.82

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

|

16

|

Total

|

1666

|

57.98

|

59.61

|

Including pure electric buses, hybrid buses, fuel cell buses and full gas buses etc.

|

Chart Three: Statistic of top 15 key regional markets' new energy buses' sales volume in Jan. - July 2012

From above data, it is seen that

1. In Jan.-July 2012, Guangdong Province accounts for the biggest market share of the new energy buses and its the market share reaches 5.78 percent, which declines 0.09 percent compared to Jan.-July 2011. In this area, the market needs are from Suzhou City, Wuxi City, Changzhou City and Nanjing City.

2. The top six regional markets of new energy buses are Guangdong Province, Jiangsu Province,Shandong Province, Beijing City, Liaoning Province, Anhui Province etc.,which are the main regional markets that the government implement the new energy buses' evelopment.

3. The new energy bus' market shares of the top 15 key regional markets reaches 57.98 percent but the concentration is not high, which decrease 1.6 percent from the first seven months of 2011. It shows the new energy buses' needs in the regional markets are decreasing.

4. In Shandong Province, the market share of the new energy buses increased by 0.8 percent from Jan.-July 2011, which is the increasing most regional market. It shows that there is some development bottleneck in its new energy bus market.

5. The sales of the new energy buses in different regional markets are rather unbalanced. It shows the sales in economic development markets are good but the market share is decreasing. For other regional markets, the new energy bus sales are increasing gradually.